does life insurance cover mortgage

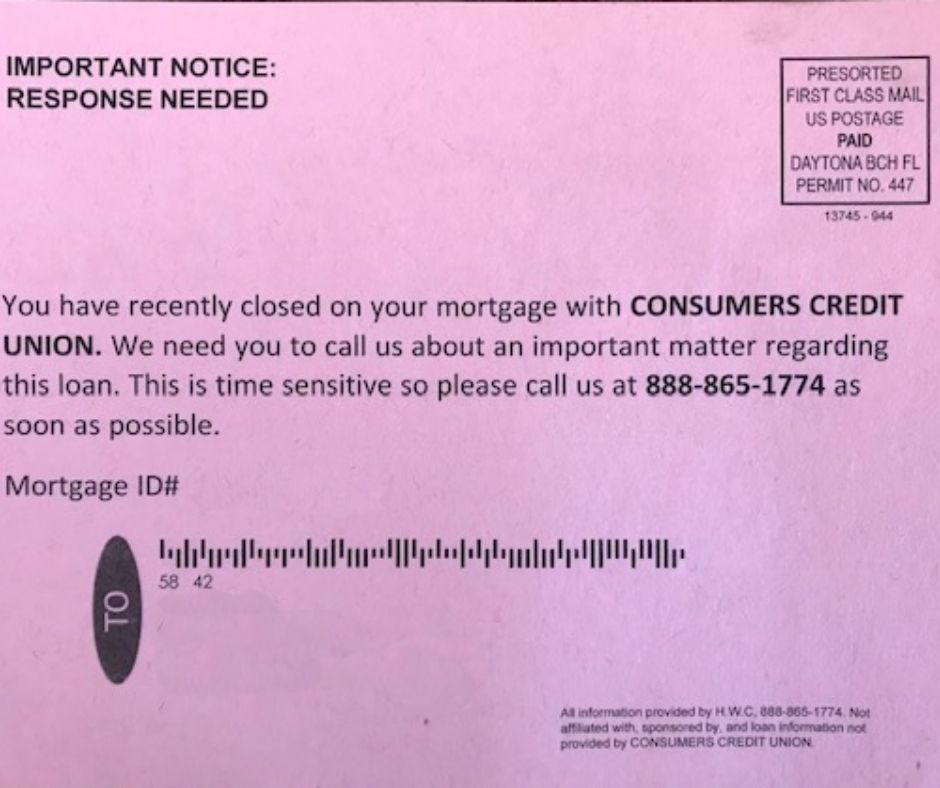

If you have recently bought an apartment or refinanced your mortgage, you'll likely get numerous solicitations for "Mortgage Life Insurance" and "Mortgage Life Insurance." In this post, we'll review the advantages and disadvantages of Mortgage Protection Insurance. Is it possible to decide if Mortgage Protection Life Insurance is a fraud or an intelligent choice?

It would help if any representative didn't pressure you. Be patient when looking at the various alternatives. We're here to aid you with this. So, don't hesitate to contact us for a complimentary consultation or to request a custom quote.